DeFi Post-Crash: 2025's Same Old Scam? - Let's Discuss!

DeFi: A Dumpster Fire Flickering in the Wind

So, DeFi's supposed to be the future, right? Decentralized, trustless, all that jazz. But let's be real, looking at the numbers post-October crash, it's less "future" and more "dumpster fire flickering in the wind." Two out of 23 freakin' tokens in the green YTD? Give me a break.

The Illusion of Safety in a Collapsing Market

And this "flight to safety" narrative? Investors supposedly flocking to buybacks and "fundamental catalysts"? It's like saying people are lining up for a slightly less moldy loaf of bread after the bakery exploded. HYPE and CAKE are the best performers? Down 16% and 12% QTD respectively? That's your safe haven? What a joke.

The "Changing Landscape" of... Losers?

This FalconX report is trying to spin this as some kind of nuanced shift, talking about how some DEXes are "cheaper" relative to September. Okay, so they're cheaper because they got hammered harder. That's not a "changing landscape," that's just gravity doing its thing. And some DEXes are posting greater 30-day fees? So what? They’re making slightly more money on a smaller pile of burning garbage.

KMNO's market cap fell 13%, while fees declined 34%? They’re trying to tell us that investors are “crowding” into lending names because lending is "stickier" than trading. Stickier like tar, maybe. Stickier like a bad investment that won’t go away no matter how hard you try to scrape it off. This whole concept of lending activity picking up because people are exiting to stablecoins is a joke too. It's like rearranging deck chairs on the Titanic.

Honestly, I’m starting to think the whole DeFi space is just a giant Ponzi scheme with extra steps. Where's the real innovation? Where's the actual use for any of this crap besides generating fees for the founders and early adopters while everyone else gets rekt?

You know what's stickier than DeFi lending? My student loan debt. At least that has a somewhat tangible asset backing it – my worthless degree.

Bitcoin to the Rescue? (Or Not?)

Oh, but wait, there's always Bitcoin, right? The "digital gold" that's supposedly going to save us all. Forecasts of $80k to $150k in 2025? Stretched target of $185k? Who are these clowns kidding? 15 Cryptocurrency Forecasts For 2025 (Updated)

Listen, I get it, Bitcoin's the OG. It's got name recognition. But let's not pretend it's immune to the same market forces that are crushing everything else. And this whole "Bitcoin dominance is breaking out" narrative? That's just code for "everything else is dying faster."

So Bitcoin is stronger than the rest of the altcoin space...so what? It's like saying a slightly less diseased rat is "stronger" than a pile of rotting corpses.

And then they trot out the eToro disclaimer: "The value of your investments may go up or down. Your capital is at risk." Yeah, no kidding. Thanks for the warning, guys. It's not like my portfolio hasn't been screaming that at me for the last six months.

December looks pivotal for Ethereum? It may retest the $4,111 level? If bullish momentum continues? It could reach a new all-time high in the next 3 months? All these conditional statements...it's just a bunch of maybes wrapped in a prayer.

Offcourse, they mention Solana too, with a potential range of $121 to $495. The $270 mark will be a "key psychological level." Oh yeah? Well, here's a psychological level for ya: the crushing weight of regret every time I check my crypto balance.

Best Crypto to Buy? More Like Best Way to Lose Money

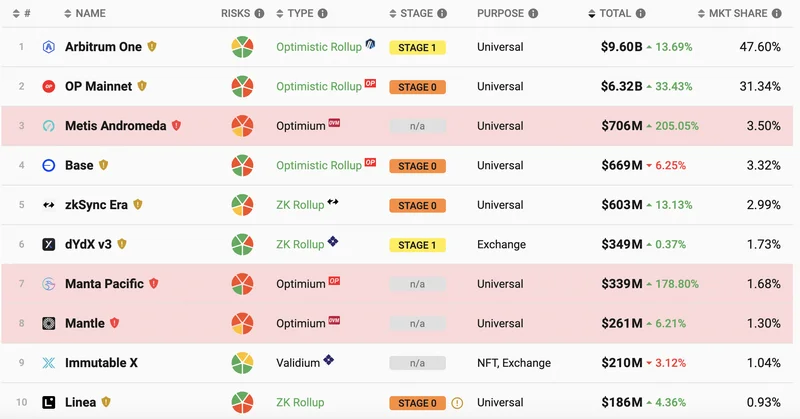

And then we get to the inevitable "Best Crypto to Buy" lists. Bitcoin, Solana, XRP, Chainlink, Ondo Finance, TRON, Hyperliquid, Immutable, NEAR Protocol, Arbitrum, Zcash...it's like they just threw a dart at a wall covered in crypto logos.

Ondo Finance, the "RWA tokenization leader"? With partnerships with BlackRock and Goldman Sachs? Sounds legit. But then they admit the token price has declined significantly from its all-time high and there are "regulatory risks in tokenized securities." So, basically, it's a crapshoot.

TRON, dominating global stablecoin transfers? But heavily reliant on USDT and facing a recent price decline? More like a house of cards built on Tether.

And Zcash? Up 560% in a month? Driven by Grayscale and an upcoming halving? RSI at 84? Sounds like a classic pump and dump waiting to happen. Plus, the EU might ban anonymous transactions by 2027? Yeah, that's a long-term winner right there.

Then again, maybe I'm the crazy one here. Maybe everyone else is seeing something I'm not. Maybe DeFi really is the future, and I'm just too cynical to see it. But honestly, I doubt it.

Crypto's Recovery: The Illusion of Strength

Next PostDeFi's 'Recovery': Don't Buy The Hype. (- Deep Dive)

Related Articles