Crypto's Recovery: The Illusion of Strength

The Bitcoin DAT Debacle: A Lesson in Premium Collapse

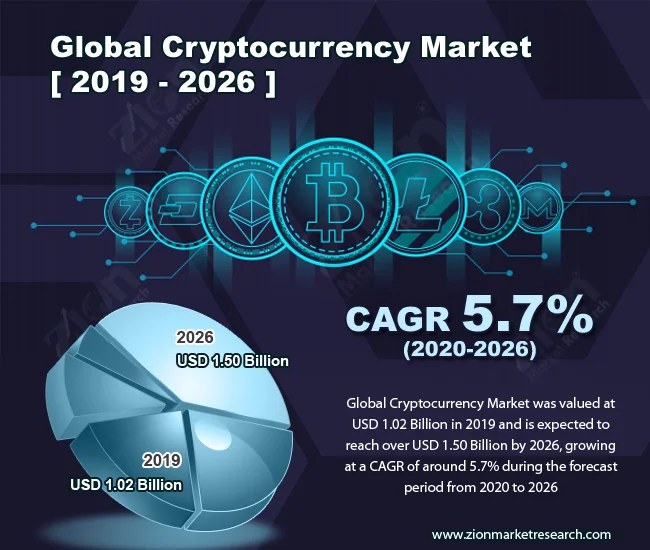

Bitcoin's wild ride in 2025 has left a trail of tears for a specific breed of investor: those who bought into the "Bitcoin Treasury Company" (DAT) model. The promise was simple: invest in a publicly traded company that holds a large Bitcoin treasury, and ride the crypto wave with leverage. But as the tide turned, many DATs found themselves underwater, proving that financial engineering can amplify losses just as effectively as gains.

The Equity Premium Problem

The core problem? A reliance on equity premiums. As Galaxy Research pointed out months ago, this model hinges on a company's stock trading above its net asset value (NAV) of Bitcoin holdings. This allows them to issue more stock, buy more Bitcoin, and theoretically, drive the price even higher. It's a classic reflexive loop. But as Bitcoin's price tumbled from its October peak of around $126,000, the music stopped. Those juicy premiums evaporated, turning stock issuance from an advantage into a liability.

When the Music Stops: DATs Underwater

Consider Metaplanet, one of the more aggressive Bitcoin accumulators. In early October, they were sitting pretty with over $600 million in unrealized profits. Fast forward to December, and they are staring at roughly $530 million in unrealized losses. (That's a swing of over one billion dollars in less than two months.) Nakamoto, another DAT, suffered an even more brutal fate, with its stock price plummeting over 98% from its highs. This isn't investing; it's memecoin-level volatility.

The real kicker is that these DATs underperformed Bitcoin itself. While Bitcoin is down roughly 30% from its highs, many DATs experienced far steeper declines. This is because they combined operational, financial, and issuance leverage, a triple whammy that amplifies both upside and downside. As Galaxy Research put it, investors should expect these shares to decline x+y% when Bitcoin itself goes down x%.

A look at the numbers reveals the extent of the damage. Back in July, Metaplanet was trading at a staggering 236% premium to its Bitcoin NAV. Now? That premium has vanished, replaced by a harsh dose of reality. The ability to issue shares above NAV and buy Bitcoin is now working in reverse, raising the specter of some firms eventually needing to sell their Bitcoin holdings to stay afloat.

And this is the part of the report that I find genuinely puzzling. Why would anyone choose this indirect, leveraged exposure to Bitcoin when they could simply buy Bitcoin directly? The answer, it seems, lies in the allure of quick riches and the seductive power of a rising market.

Darwinian Selection: Survival of the Fittest

So, what's next for these Bitcoin treasury companies? DAT’s All, Folks? What’s Next for Bitcoin Treasury Companies outlines three plausible scenarios, and none of them are particularly rosy. The most likely outcome is that premiums remain compressed as long as crypto markets remain soft. In this scenario, DAT equities offer leveraged downside, not upside, compared to spot Bitcoin. Investors banking on a return to the "equity beta > BTC beta" regime are likely to be disappointed.

Another possibility is selective survival and consolidation. This drawdown is essentially a balance-sheet stress test. Companies that issued the most stock at the highest premium, bought the most Bitcoin at cycle-top prices, and layered on debt are the most vulnerable. Prolonged discounts and large unrealized losses could trigger restructurings, with stronger players (like Strategy) acquiring weaker ones at a discount. (Think of it as a Darwinian phase for DATs.)

Strategy, for example, recently announced a $1.44 billion cash reserve to cover dividend and interest commitments. This marks a significant evolution in the DAT model, signaling a shift from pure Bitcoin accumulation to proactive liquidity management. It also shows that they are planning to weather a prolonged period of compressed premiums and weaker Bitcoin prices.

The final scenario is optionality on the next cycle. If and when Bitcoin eventually prints new all-time highs, some DATs might regain modest equity premiums and reopen the issuance flywheel. But the bar is now higher. Boards and management teams will be judged on how they handled this first real stress test. Did they over-issue into the top? Did they preserve optionality? How did they handle the downturn? Are their shareholders willing to get back on for another ride? The key takeaway is that these companies now look less like simple "leveraged upside on BTC" plays and more like path-dependent instruments whose payoffs depend heavily on issuance strategy and entry timing.

Reality Bites

The Bitcoin treasury company model didn't just "mysteriously stop working." It hit the natural boundary condition that Galaxy Research laid out months ago: once the equity trades at or below BTC NAV, issuance becomes a tax instead of a growth engine. This episode serves as a valuable lesson in the dangers of chasing premiums and the importance of understanding the underlying fundamentals of any investment.

The Premium Mirage

The numbers don't lie: the DAT gravy train has derailed, leaving investors with a harsh reminder that leveraged bets can quickly turn sour.

✔️ Final Title: Agentic AI 'Sustainability': Another Corporate Delusion? (AI-Powered Growth!)

Next PostDeFi Post-Crash: 2025's Same Old Scam? - Let's Discuss!

Related Articles