DeFi's 'Recovery': Don't Buy The Hype. (- Deep Dive)

DeFi's "Safety" Play Is Just Lipstick on a Pig, Isn't It?

So, DeFi's having a rough go of it, huh? According to some report I'm supposed to care about, most of the "leading" DeFi tokens are tanking. Down 37% this quarter? Give me a break. Like anyone actually thought these magic internet beans were a safe haven in the first place. DeFi Token Performance & Investor Trends Post-October Crash

The Illusion of Safety in DeFi

The narrative now is that investors are "opting for safer names." Safer? In DeFi? That's like saying you're opting for the slightly less rusty knife in a serial killer's collection. It's all still gonna end badly.

Buybacks and "Fundamental Catalysts": Just More Spin?

Apparently, these "safer" names are the ones with buybacks, like HYPE and CAKE. Oh, so now we're impressed by financial engineering in a sector built on "decentralization"? Let's be real, buybacks are just a way for these projects to prop up their failing tokens while insiders quietly cash out. It's like watching a toddler try to fix a broken dam with a bucket.

And then there are the tokens with "fundamental catalysts," like MORPHO and SYRUP. Minimal impact from some collapse, growth somewhere else... It all sounds like desperate spin. The whole DeFi space is just a game of musical chairs, and when the music stops, most of these "fundamental catalysts" are gonna be worthless.

DEXes Cheapening Out? Shocker.

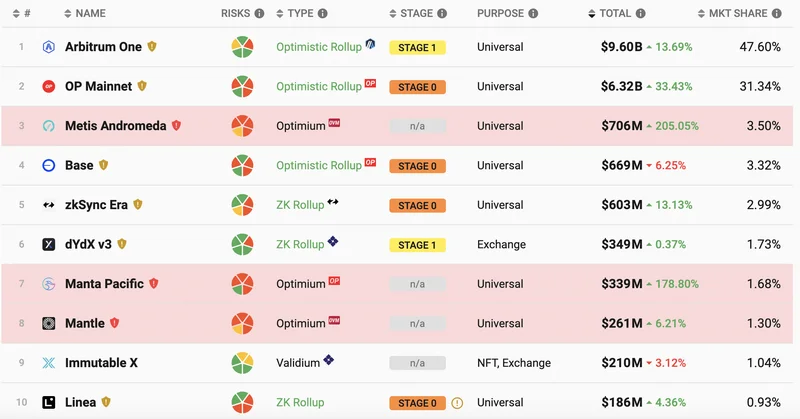

Oh, and get this: some DeFi subsectors are getting "cheaper" relative to others. Spot and perpetual DEXes are seeing their price-to-sales multiples decline. Well, offcourse they are. The entire premise of these DEXes is flawed. They're supposed to be decentralized alternatives to centralized exchanges, but they're really just slower, more expensive, and less user-friendly versions of the same thing.

DEX Fees: Gouging Users During a Hurricane

And the fact that some DEXes are posting greater 30-day fees? That's not a sign of health; it's a sign that they're gouging their users. It's like a gas station raising its prices during a hurricane – technically "profitable," but morally bankrupt.

Predatory Lending in Disguise

Then there's the lending sector, which is supposedly "steepening on a multiples basis." What that really means is that these lending platforms are charging exorbitant interest rates to desperate users who are trying to squeeze some yield out of their stablecoins. It's predatory lending dressed up in the language of "decentralized finance."

"Stickier" Lending Platforms: Flypaper for Crypto

But hey, investors are "crowding into lending names" because they're seen as "stickier." Stickier like flypaper, maybe. These lending platforms are just sucking the life out of the crypto ecosystem, and when the whole thing collapses, they'll be the first to go down. I'm sure we'll get some clown telling us that it's "innovative."

The Crystal Ball of "Potential Opportunities"

This FalconX report claims these trends reveal "potential opportunities from dislocations." Opportunities for whom? The insiders who are already rich? The VCs who dumped their tokens on retail investors?

More Gambling Isn't a Healthy Market

They expect us to believe this nonsense, and honestly...

The report suggests investors expect perps to keep leading the way, pointing to HYPE's "perps on anything" markets. But wait, are we really supposed to believe that more gambling on crypto is a sign of a healthy market? It's like saying the key to fixing a gambling addiction is to bet on more things.

Luring TradFi Users with a Fresh Coat of Paint

And then there's the idea that "fintech integrations" will drive growth in lending. AAVE's "high-yield savings account" and MORPHO's Coinbase integration are supposed to be examples of this. But let's be real, these are just attempts to lure in unsuspecting TradFi users who don't know any better. It's like putting a fresh coat of paint on a dilapidated building and hoping no one notices the foundation is crumbling.

Cynicism or Realism?

Maybe I'm just too cynical. Maybe there really are "potential opportunities" in this mess. But I've seen this movie before, and it always ends the same way: with retail investors getting rekt and the insiders walking away with bags of cash. Ain't gonna be me.

DeFi Post-Crash: 2025's Same Old Scam? - Let's Discuss!

Next PostThis is the latest post.

Related Articles