Why Bitcoin's Slide Defies Open Interest Data (- #CryptoInsights)

Crypto Market in 2025: A Dichotomy of Regulation and Volatility

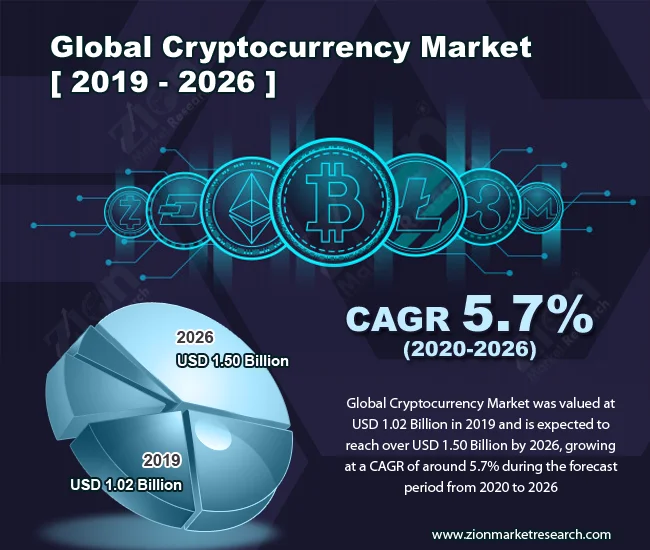

The crypto market in 2025 presented a fascinating dichotomy: increasing regulatory clarity clashing with the volatile, often irrational realities of market behavior. We saw governments worldwide scrambling to regulate stablecoins, institutions tentatively dipping their toes in digital assets, and, as always, the specter of illicit finance lurking in the shadows. But will these regulatory efforts actually tame the beast, or simply push it further into the dark corners of the internet?

The Stablecoin Scramble: A Race Against Volatility

Stablecoins, pegged to fiat currencies like the US dollar, were a major focal point for regulators in 2025. The TRM Labs report indicates that over 70% of the jurisdictions reviewed progressed stablecoin regulation. The US passed the GENIUS Act, the EU rolled out MiCA, and Hong Kong, Japan, Singapore, and the UAE all made strides in defining standards for issuance, reserves, and redemption. The underlying assumption? That stablecoins, due to their (supposed) stability, could become legitimate mediums of exchange on public blockchains.

But here's the rub: the "stability" of stablecoins is often an illusion. S&P Global downgraded Tether (USDT), assigning it the lowest score on their peg stability scale, citing weaker reserve quality and rising exposure to secured loans and Bitcoin. Tether's CEO, Paolo Ardoino, dismissed the rating as biased, but the numbers don't lie (or at least, they present a different narrative). If a stablecoin's reserves are increasingly tied to volatile assets like Bitcoin, how "stable" is it, really? It's like building a house on a foundation of sand – or perhaps a Jenga tower.

It also begs the question: if regulators are so focused on stablecoins, are they missing the bigger picture? Are they meticulously regulating the on-ramp while ignoring the off-ramp, where illicit actors can still exploit unregulated exchanges and decentralized finance (DeFi) protocols?

Institutional Adoption: A Slow and Cautious Dance

The TRM Labs report also highlights that about 80% of the jurisdictions reviewed saw financial institutions announce digital asset initiatives in 2025. This was fueled by increasing regulatory clarity, particularly in markets like the US, EU, and parts of Asia. Texas even became the first US state to publicly invest in Bitcoin – a symbolic move, according to Bitfinex analysts. Crypto Market Enters a Stabilisation Phase, Experts Say.

However, institutional adoption is not a monolithic phenomenon. It's more like a slow, cautious dance. BlackRock increased its IBIT fund reserves by 14%, while ARK Invest continued to invest in crypto companies despite liquidity pressures. But these are still relatively small steps. Are traditionally conservative bond funds really using Bitcoin ETFs as diversification tools, or are they simply allocating a tiny percentage of their portfolio to "explore" the space?

I've looked at hundreds of these filings, and the language is always carefully worded. It's never a full-throated endorsement, but rather a cautious acknowledgement of "potential" and "emerging opportunities." This suggests that institutions are still hedging their bets, waiting to see how the regulatory landscape evolves and how the market performs before committing significant capital.

And this is the part of the report that I find genuinely puzzling: the Basel Committee announced a review of its proposed prudential rules for banks’ crypto exposures. The original framework would have required full capital deductions for most crypto assets, including certain stablecoins on public blockchains. Why the reassessment? Is it a genuine softening of regulatory attitudes, or simply a recognition that the original framework was too draconian and would stifle innovation?

The Shadowy Underbelly: Illicit Finance and Regulatory Arbitrage

Despite increasing regulatory efforts, illicit finance remains a persistent challenge in the crypto space. The TRM Labs report notes that virtual asset service providers (VASPs), which are the most widely regulated segment of the crypto ecosystem, have significantly lower rates of illicit activity than the overall ecosystem. This suggests that regulation is having some impact, but it's not a silver bullet.

North Korea's record-breaking hack on Bybit in early 2025, which led to the exchange losing over USD 1.5 billion in Ethereum tokens, underscores the limitations of current regulatory frameworks. The attackers laundered proceeds through unlicensed over-the-counter (OTC) brokers, cross-chain bridges, and decentralized exchanges – infrastructure that largely sits outside existing regulatory perimeters. The incident highlighted how illicit actors exploit unregulated or lightly supervised technologies to obscure funds, reinforcing the need for better cross-jurisdictional coordination and real-time information sharing between compliant VASPs and law enforcement.

The Financial Action Task Force (FATF) warned that as long as gaps in standards implementation persist, “VASPs in jurisdictions with weak or non-existent frameworks” remain vulnerable to exploitation “without detection or disruption.” This highlights the problem of regulatory arbitrage, where illicit actors simply move their operations to jurisdictions with lax regulations.

The Coming Crackdown

The crypto market in 2026 stands at a crossroads. Will increasing regulatory clarity lead to greater institutional adoption and a more stable, mature market? Or will the volatile realities of market behavior and the persistent threat of illicit finance undermine these efforts?

The Financial Services and Markets Act (FSMA) in Singapore, for example, introduces a licensing regime for digital token service providers (DTSPs) that operate in or from Singapore, even if they only serve overseas markets. But MAS (Monetary Authority of Singapore) h

Boomtown: What It Is, Casino to Brewery – The Full Picture

Next Post✔️ Final Title: Agentic AI 'Sustainability': Another Corporate Delusion? (AI-Powered Growth!)

Related Articles